Optimizing UK Mergers and Acquisitions with Expert Translation Services

In the UK's mergers and acquisitions (M&A) sector, precise legal and financial documentation is indispensable due to the high stakes and complexity involved. Specialized UK translation services play a pivotal role by offering nuanced transl…….

In the UK's mergers and acquisitions (M&A) sector, precise legal and financial documentation is indispensable due to the high stakes and complexity involved. Specialized UK translation services play a pivotal role by offering nuanced translations that understand both language intricacies and M&A-specific terminology, ensuring accuracy in contracts, statements, and reports. These services are critical for compliance with UK legal standards and for fostering trust among stakeholders. Translators must be experts in M&A law, accounting principles, and corporate governance to adapt documents to align with the legal frameworks of both the acquiring and target companies, thereby mitigating risks associated with language barriers or translation errors. The selection of a specialized UK translation service is a strategic decision that can significantly impact the success of M&A transactions, especially given past significant deals like ABInBev's acquisition of SABMiller and SoftBank Group's purchase of ARM Holdings, which underscored the importance of precise translations. Essential Language Solutions exemplifies this expertise, providing compliant and technically proficient translation services tailored to M&A documentation in the UK, ensuring that all technicalities and nuances are accurately conveyed, and maintaining a rigorous quality assurance process for seamless cross-border transactions.

When venturing into the realm of mergers and acquisitions within the UK, the strategic importance of precise language cannot be overstated. Navigating this complex legal and financial terrain often hinges on the clarity and accuracy of M&A documents. Specialized translation services emerge as indispensable allies in this process, ensuring that all linguistic intricacies are seamlessly addressed. This article delves into the critical role these services play, offering insights through case studies and highlighting the importance of compliance and precision in M&A documentation within the UK context.

- Navigating the Nuances of M&A in the UK: The Role of Specialised Translation Services

- Key Considerations for Choosing a Reliable Translation Provider for M&A Documents

- Case Studies: Successful Mergers and Acquisitions in the UK Enhanced by Expert Translation

- Essential Language Solutions: Ensuring Accurate and Compliant Documentation for M&A Deals in the UK

Navigating the Nuances of M&A in the UK: The Role of Specialised Translation Services

When companies engage in mergers and acquisitions (M&A) within the UK, the accuracy and clarity of legal and financial documentation are paramount. The stakes are high, with critical decisions hinging on the precise translation of complex documents. Specialized translation services play a pivotal role in this process, ensuring that all parties involved have an unambiguous understanding of the terms and conditions. These services are not merely linguistic conversions but involve a deep comprehension of both language nuances and M&A-specific terminology. UK translation services provide assurance that legal contracts, financial statements, and due diligence reports are accurately translated, reflecting the letter and spirit of the original documents. This is crucial for maintaining compliance with UK laws and regulations, and for fostering trust among all stakeholders during the M&A process.

The intricacies of UK M&A transactions often necessitate not just a translation but a careful adaptation to the legal frameworks of both the acquiring and target entities. Specialized translators who are well-versed in the subtleties of M&A law, accounting standards, and corporate governance are indispensable. They bridge cultural and linguistic divides, ensuring that the intentions and obligations outlined in documents are accurately conveyed. This meticulous attention to detail is essential for a successful transaction, as it mitigates misunderstandings and legal risks that could arise from language barriers or mistranslations. Thus, choosing a translation service with expertise in M&A documents within the UK context is not just a logistical decision but a strategic one that can influence the outcome of the entire deal.

Key Considerations for Choosing a Reliable Translation Provider for M&A Documents

When navigating mergers and acquisitions (M&A), the precision and clarity of documentation are paramount, especially when these documents cross linguistic boundaries. Selecting a reliable translation provider is a critical step for organisations operating within the UK, where M&A activities frequently require accurate translations of legal and financial materials. The chosen translation service must possess specialized expertise in M&A documents to ensure that the translated content accurately reflects the nuances and complexities inherent in such transactions. Key considerations include the provider’s proficiency in the relevant language pairs, particularly those commonly used in UK business, such as English to and from French or German; their understanding of industry-specific terminology and jargon; and their ability to maintain confidentiality due to the sensitive nature of M&A documents. Additionally, the provider should have a proven track record of delivering high-quality translations within tight deadlines, as time sensitivity is often a factor in M&A deals. It is also essential that they offer a range of services, from legal and financial translations to certified translations when necessary, ensuring compliance with both UK and international regulations. By carefully evaluating these factors, companies can select a translation provider that will facilitate effective communication and due diligence across borders during M&A activities in the UK.

Case Studies: Successful Mergers and Acquisitions in the UK Enhanced by Expert Translation

In the dynamic landscape of UK mergers and acquisitions, the role of meticulous translation services cannot be overstated. A prime example of this is the successful integration of ABInBev and SABMiller, where seamless translation of mergers and acquisitions documents was pivotal to navigating the complexities of two global giants coming together. The transaction involved a vast array of financial and legal documentation that required precise translation between English and several other languages, ensuring that all parties had a clear understanding of the terms and conditions. This level of linguistic accuracy is not just a matter of semantics but a critical component in fostering trust and transparency during the M&A process.

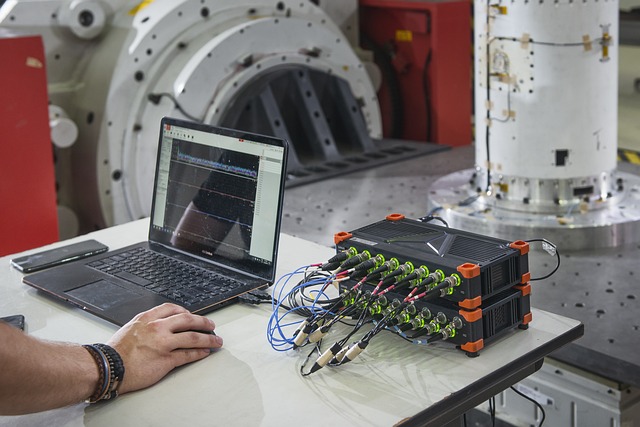

Another case in point is the acquisition of ARM Holdings by SoftBank Group. The deal’s success hinged on the precise translation of technical documents, which facilitated a smooth transition and integration of the companies. The UK translation services provided for this transaction were instrumental in conveying the intricate details of ARM’s groundbreaking technology to SoftBank’s international stakeholders, enabling informed decision-making and effective communication across borders. These case studies underscore the importance of reliable translation services in the M&A context, where precision and cultural sensitivity are paramount for achieving business objectives and ensuring the seamless operation of newly formed entities.

Essential Language Solutions: Ensuring Accurate and Compliant Documentation for M&A Deals in the UK

In the complex arena of mergers and acquisitions within the UK, precise and compliant documentation is paramount for successful transactions. Essential Language Solutions stands at the forefront of providing bespoke translation services tailored to the nuanced demands of M&A deals. With a deep understanding of the legal and financial terminology inherent in these processes, their linguistic experts ensure that all documents are not only accurately translated but also reflect the intricacies of UK business law. This commitment to accuracy and compliance is crucial for international parties involved in cross-border transactions, facilitating seamless communication and aiding in the due diligence phase where every detail matters. Moreover, their comprehensive approach encompasses a variety of languages, guaranteeing that both parties have a clear and mutual understanding of the terms and conditions at hand. This level of service is instrumental in building trust between merging entities, which is essential for smoothing out any cultural or linguistic barriers that may arise during such high-stakes negotiations.

The translators at Essential Language Solutions are not just language experts but are also well-versed in the intricacies of M&A documents UK translation services cater to. Their expertise spans across various sectors, including finance, technology, and healthcare, ensuring that every technicality and financial nuance is accurately conveyed in the target language. This expertise is underpinned by a robust quality assurance process that includes proofreading and verification by industry-specific professionals, further cementing the reliability of their services. In the fast-paced environment of UK mergers and acquisitions, where time sensitivity is critical, Essential Language Solutions provides a swift yet meticulous translation service that upholds the integrity of all documentation involved in the deal.

In concluding our exploration of the vital role translation services play in UK mergers and acquisitions, it’s clear that precise and compliant language solutions are indispensable for successful cross-border deals. Specialized translation providers adeptly navigate the complexities of M&A documentation within the UK context, ensuring clarity and accuracy in communication. As evidenced by the case studies presented, expert linguistic support not only facilitates smooth transaction processes but also contributes to the strategic objectives of these corporate ventures. For companies engaged in mergers and acquisitions within the UK, partnering with trusted translation services is a prudent step towards mitigating risks and achieving deal success.